Wealth Management Can Be Fun For Everyone

Wiki Article

The 5-Second Trick For Wealth Management

Table of ContentsSome Known Facts About Wealth Management.Not known Facts About Wealth ManagementThe 45-Second Trick For Wealth ManagementAbout Wealth ManagementSome Known Details About Wealth Management The Ultimate Guide To Wealth Management

However, many do not have access to an employer-sponsored retirement plan, such as a 401( k) strategy. Even if your company does not use a retired life strategy, you can still conserve for retired life, by placing cash in an Individual Retirement Account (INDIVIDUAL RETIREMENT ACCOUNT). Slow and also constant wins this race.While your retirement may appear a lengthy method off, you owe it to yourself to look towards the future and also begin considering what you can do today to assist make certain a protected retirement tomorrow. Although time may get on your side, if you ask a few of the senior citizens you know, they will probably tell you that conserving for retirement is not as straightforward as it initially shows up.

Many individuals don't understand the potentially serious results of inflation. At 35 years, this amount would certainly be additional reduced to simply $34. Therefore, it is crucial to look for retirement cost savings vehicles that have the best opportunity of outpacing inflation.

Wealth Management for Dummies

The faster you identify the impacts that economic pressures can have on your retirement revenue, the a lot more most likely you will be to adopt methods that can aid you achieve your long-term goals - wealth management. Being aggressive today can help increase your retirement cost savings for tomorrow.If intending for retired life appears like it may be dull or difficult, think again It's your chance to consider your goals for the future and also form a brand-new life survived your terms. Taking a little bit of time today to consider your life in the future can make all the difference to your retired life.

A retired life plan helps you obtain clear on your goals for the future, such as how you will spend your time, where will you live and whether your spouse feels the same. Understanding when you prepare to retire makes it less complicated to prepare. Some points to take into consideration consist of the age you can retire, tax obligation results as well as income demands.

The Definitive Guide for Wealth Management

A retirement financial savings method that considers your income, very balance, spending plan and staying functioning years could supply the increase your super requirements. Senior citizens and pre-retirees deal with some unique dangers when it comes to their financial investments. A retirement can help you take care of vital dangers as well as ensure your investments adjust to fit your stage of life.

A retired life plan will certainly explore your choices including revenues from part-time work, financial investment revenue, the Age Pension plan as well as very savings. Dealing with a knowledgeable retired life organizer can help provide monetary safety and security as well as assurance. It can offer you confidence that you get on track to be able to do things you want in retirement.

Below's why you must begin preparing beforehand instead of when it's as well late. Retirement takes you to a brand-new stage of your life wherein you can genuinely make time on your own and also enjoy activities that you have actually not been able to take note of during your job life.

The Wealth Management Ideas

Investing in a retirement plan is needed to guarantee this same criterion of living post-retirement. That will aid you with a stable revenue every month even after retiring.

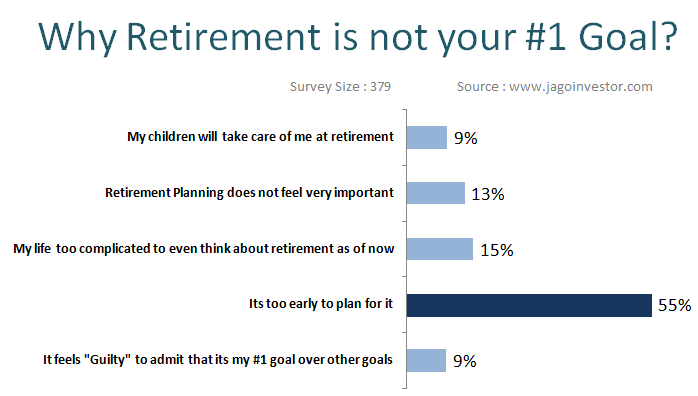

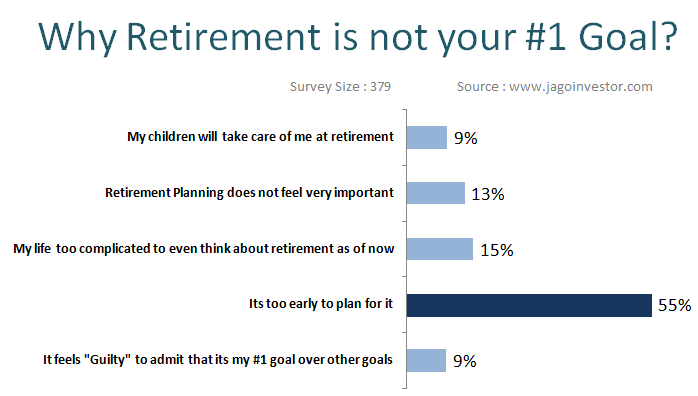

This suggests that an individual will certainly have to pay more for all expenditures in the future. Therefore, while carrying out vital retirement preparation, like this you can consider this determinant as well as create an adequate retired life fund for your future to live a relaxed life. After your retired life, you shouldn't rely on anybody, specifically your loved ones.

The 7-Minute Rule for Wealth Management

Yet, with all these advantages and also more, you can not refute the truth that this is certainly a terrific financial investment chance to surrender on. That's best beginning today!. Since you have actually comprehended the importance of retired life planning, you can start by refining your smart retirement today.

Preparation for retirement is a method to help you preserve the same high quality of life in the future. You may not want to work permanently, or be able to completely rely upon Social Safety. Retired life preparation has 5 actions: recognizing when to begin, calculating just how much money you'll need, setting concerns, picking accounts and choosing investments.

7 Simple Techniques For Wealth Management

When you can retire boils down to when you wish to retire as well as when you'll have adequate money conserved to replace the income you receive from functioning. The earliest you can start claiming Social Safety benefits is age 62. Nevertheless, by filing early, you'll compromise a portion of your benefits.

And your advantage will really raise if you can delay it additionally, up until age 70. Some people retire early (due to the fact that they want or need to), and lots of retire later (once again, since they desire or need to). Numerous people find it's finest to gradually ease of the Continued workforce instead of retire suddenly.

When should you start retirement preparation? Also if you have not so much as considered retired life, every dollar you can save currently will be much valued later on.

Report this wiki page